innosvet74.ru

Overview

Top 10 Best Homeowners Insurance Companies

Compare The Best Home Insurance Companies ; Allstate. Best For Home Sharing ; Openly. Best For Extended Coverage ; American Family. Best For. Top 10 Tips for Finding Residential Insurance · Residential Insurance Company Contact List · Home Insurance Finder · Compare Premiums · List of Carriers. State Farm: Best home insurance for home and auto bundling. USAA: Best home insurance for veterans and military. Allstate: Best home insurance for home-sharing. Amica often comes out on top in customer satisfaction reviews, and they offer an optional HO5 policy which covers your personal property on an open perils. Insurance Panda: They're making waves with their affordable policies. Definitely a go-to for budget-conscious drivers. · State Farm: This one's a. property and casualty (P&C) insurance industry. Find Industry Resources Top 10 ways to help save money on home insurance. Shop around and compare. Mercury is the best home insurance company for most people in California. It's the cheapest widely-available option and has dependable service. Erie Insurance topped the list in It was selected as the No. 1 company for homeowner satisfaction. Satisfaction score (homeowners): /1, The price of a typical homeowners insurance policy in the U.S. rose about 10 percent in , according to the Insurance Information Institute, an industry. Compare The Best Home Insurance Companies ; Allstate. Best For Home Sharing ; Openly. Best For Extended Coverage ; American Family. Best For. Top 10 Tips for Finding Residential Insurance · Residential Insurance Company Contact List · Home Insurance Finder · Compare Premiums · List of Carriers. State Farm: Best home insurance for home and auto bundling. USAA: Best home insurance for veterans and military. Allstate: Best home insurance for home-sharing. Amica often comes out on top in customer satisfaction reviews, and they offer an optional HO5 policy which covers your personal property on an open perils. Insurance Panda: They're making waves with their affordable policies. Definitely a go-to for budget-conscious drivers. · State Farm: This one's a. property and casualty (P&C) insurance industry. Find Industry Resources Top 10 ways to help save money on home insurance. Shop around and compare. Mercury is the best home insurance company for most people in California. It's the cheapest widely-available option and has dependable service. Erie Insurance topped the list in It was selected as the No. 1 company for homeowner satisfaction. Satisfaction score (homeowners): /1, The price of a typical homeowners insurance policy in the U.S. rose about 10 percent in , according to the Insurance Information Institute, an industry.

What are the most popular homeowners insurance companies? ; State Farm, % ; Allstate, % ; Liberty Mutual, % ; USAA, %. Great rates and expert advice on home insurance. Get a free online quote 1 for coverage to protect you, your property, and your belongings from the unexpected. 10 Best Homeowners Insurance Companies of · 1. Allstate 2. American Family 3. Amica 4. Chubb 5. Erie 6. Farmers 7. Lemonade 8. Nationwide 9. State Fa. USAA Homeowners Insurance ranks among the top home insurers for its customer experience. Save up to 10% on your premiums when you bundle homeowners and auto. Amica and Andover Companies are among our picks for the best homeowners insurance companies in the U.S. Compare more top-rated home insurers now. The best insurance companies for bundling auto and home ; Best overall for auto and home — USAA. · USAA. stars · Up to 10% discount for bundling ; Best for. top ten largest home insurance providers in the country. However, the Average Rates of the Best Homeowners Insurance Companies in Florida. Company. Compare The Best Home Insurance Companies ; Allstate. Best For Home Sharing ; Openly. Best For Extended Coverage ; American Family. Best For. A canine liability exclusion, a component of homeowner's insurance policies, indemnifies the insurance company against damages caused by the policyholder's dogs. The Colorado Division of Insurance has created this report, to provide consumers an opportunity to compare auto insurance premium rates in Colorado. Top Home Insurance Companies in · Amica · State Farm · USAA · Liberty Mutual · Allstate · Farmers · Progressive · Travelers. The highest rated the best for customer service, Amica Insurance offers several benefits to their consumers. Not just covering home owners insurance, Amica also. 1. State Farm · 2. Allstate Corp. · 3. USAA Insurance Group · 4. Farmers Insurance Group · 5. Liberty Mutual · 6. Travelers Companies Inc. · 7. Nationwide Mutual. You're in Good Hands with Allstate®. Our dedicated local insurance agents are here to help you with any questions you have. Excellent claims service. We'll give. Find the best rates from the top Alberta home insurance companies and save more At ThinkInsure, we help homeowners get the best policies at the most. How to get a homeowners insurance quote. A good place to begin is with your car insurance provider. This will allow you to bundle your policies and receive a. Although State Farm is a household name in both the auto and home insurance industry, they do not necessarily provide great value for their rates. Despite. Search AM Best's extensive database of life/health, property/casualty insurance companies worldwide and access Best's Credit Ratings, Best's Credit Reports and. State Farm, Stillwater, American Family, Farmers, and Nationwide offer top-notch insurance. Learn why they're the best home insurance companies for many. The largest P&C insurers in the United States ; 2, Berkshire Hathaway Ins, 77,, ; 3, Progressive Ins Group, 61,, ; 4, Allstate Ins Group, 47,, ; 5.

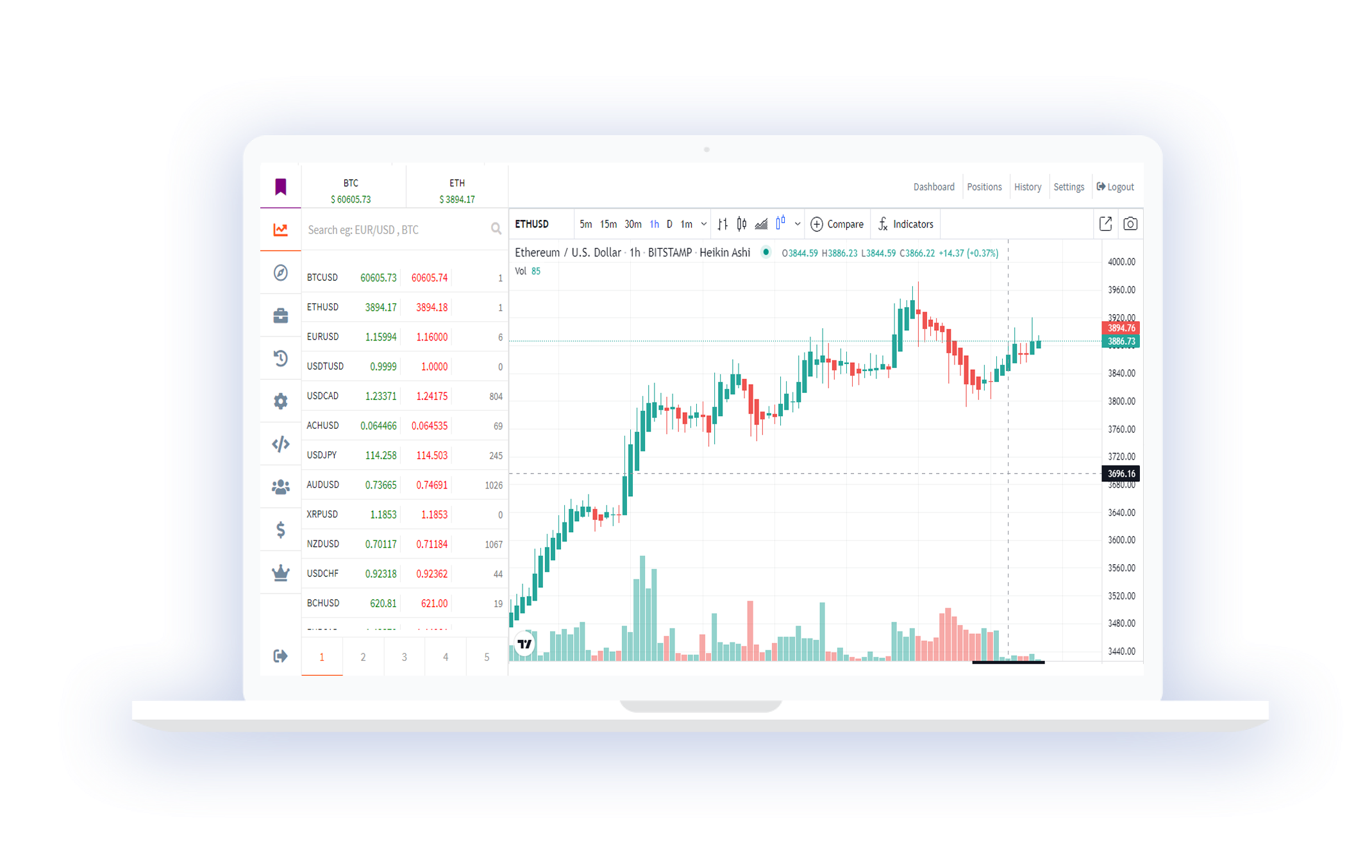

White Label Forex Broker Cost

The cost of a complete turnkey white label solution can vary from $ to $ This is for the white label site, the branding, and your custom. Therefore, the cost of starting a brokerage with a white label solution will be directly proportional to the service you choose. What features. The pricing per bundle with the most well-known provider of trading technology starts at $ 3, per month. The smallest bundles at X Open Hub start at $1, Broker White Label Solutions provides the best white-label forex solutions for your trading business. Explore our range of white forex label solutions and. Being a forex broker is a challenging task, as they are required to offer a wide range of services to their clients, including trading accounts. Another crucial element that's usually ignored is the connection your white label broker has with fee suppliers. What's A White-label Dealer In Forex? This. This article explores the various factors that influence the cost of a forex white label and helps you make an informed decision. Brokers earn revenue through spreads, commissions, and other trading-related fees. With proper management and a growing client base, a brokerage can generate. It comes with a cost of $ as initial set up cost and $ as monthly maintenance cost. Please email at [email protected] and one of our representatives. The cost of a complete turnkey white label solution can vary from $ to $ This is for the white label site, the branding, and your custom. Therefore, the cost of starting a brokerage with a white label solution will be directly proportional to the service you choose. What features. The pricing per bundle with the most well-known provider of trading technology starts at $ 3, per month. The smallest bundles at X Open Hub start at $1, Broker White Label Solutions provides the best white-label forex solutions for your trading business. Explore our range of white forex label solutions and. Being a forex broker is a challenging task, as they are required to offer a wide range of services to their clients, including trading accounts. Another crucial element that's usually ignored is the connection your white label broker has with fee suppliers. What's A White-label Dealer In Forex? This. This article explores the various factors that influence the cost of a forex white label and helps you make an informed decision. Brokers earn revenue through spreads, commissions, and other trading-related fees. With proper management and a growing client base, a brokerage can generate. It comes with a cost of $ as initial set up cost and $ as monthly maintenance cost. Please email at [email protected] and one of our representatives.

White Label · White Label: $5, - $15, · Liquidity Providers: $1, - $8, · MT4/MT5 Providers: $5, - $6, · Broker's CRM: $2, - $5, · Software. Leverate is a trusted provider of white-label solutions for brokers and prop trading platforms. Our credibility is global, chosen by hundreds of brokers. brokers to access deep liquidity and offer competitive pricing to their clients. The white label program allows the third-party entity to offer forex. forex broker based on the existing ForexChief technological infrastructure at minimum financial costs. Taking into account the high licensing fees. A White Label Forex brokerage, is a low cost solution compared to starting one from scratch. Transform your online trading business with allFX-Consult. white label forex broker cost white label forex broker cost | Top Forex Brokers List With Bonus Deposite innosvet74.ru arbitrage bot forex. With no initial investment or monthly fees, we provide a straight-forward and cost-effective route to market. How it works. 1. The cost of setting up a forex brokerage can be determined by considering the countries your broker wishes to target, marketing budget, whether you will apply. Comparing Forex White Label Providers: Which Presents The Most Effective Worth In Your Cost? Professionals And Cons Of White Label Forex Brokers. The. These include the level of customization wanted technology necessities white label forex broker cost regulatory compliance and ongoing assist. Generally, setup. White label forex broker setups require careful cost management. They emphasise the significance of understanding overall costs that balance startup. Fintechee provides White Label Broker Forex and Forex White Label cost as Forex White Label Provider. White Label Spread Betting Platform is a kind of. The white label service includes detailed documentation for each feature and transparent pricing, with a one-time setup fee of $5, and a monthly support fee. Forex broker/dealers software. With a White Label you will earn commissions on every trade that your clients make. You will receive your own trading. No forex broker will publicise their cost (for the obvious reason of fierce competition) but the pricing ranges between $5k-$12k one-off cost for getting. A White Label brokerage is a foreign exchange brokerage firm that offers its services to other firms or companies that can rebrand them under their own name. White label brokerage solutions range in price from a few thousand dollars to $,, with the average cost ranging from $10, to $50, Costs vary based. white label forex broker. However, if you are new to FX here is a quick FX brokers at times charge additional fees for access to a particular. MT4 White Label Cost. Low MT4 White Label Price for starting your own forex broker brand. Financial News & Alerts. Prompt alerts. Cost Efficiency One of the primary advantages of becoming a white label forex broker is the significant cost savings. Developing a trading.

How To Find My Ein Number Online

There is no way to find an Employer Identification Number online because the Internal Revenue Service does not publish or share the taxpayer. How do I get my EIN confirmation letter? · Call the IRS: If you need to contact the IRS, it'll have to be over the phone. · Speak to an agent: Once you're on the. Simply call () and select EIN from the list of options. Once connected with an IRS employee, tell the assistor you received an EIN from the Internet. After you submit your online application with all the required information, you should receive your federal tax ID number, Opens overlay. You can view, download. These services are free. EIN. An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business. We make obtaining Employer Identification Numbers easy and hassle-free. We will handle all of the paperwork to file for an EIN on your behalf using the business. EIN Database: If the company you are researching isn't publicly traded or a nonprofit there are some databases online that will allow you to lookup an EIN, or. In some cases, you can find an EIN online if it's been separately disclosed in another filing. For example, in the state of Florida, there is a. To verify a charitable organization's EIN, you can check the IRS Tax Exempt Organization Search tool. You may also be able to hire an online company to do the. There is no way to find an Employer Identification Number online because the Internal Revenue Service does not publish or share the taxpayer. How do I get my EIN confirmation letter? · Call the IRS: If you need to contact the IRS, it'll have to be over the phone. · Speak to an agent: Once you're on the. Simply call () and select EIN from the list of options. Once connected with an IRS employee, tell the assistor you received an EIN from the Internet. After you submit your online application with all the required information, you should receive your federal tax ID number, Opens overlay. You can view, download. These services are free. EIN. An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business. We make obtaining Employer Identification Numbers easy and hassle-free. We will handle all of the paperwork to file for an EIN on your behalf using the business. EIN Database: If the company you are researching isn't publicly traded or a nonprofit there are some databases online that will allow you to lookup an EIN, or. In some cases, you can find an EIN online if it's been separately disclosed in another filing. For example, in the state of Florida, there is a. To verify a charitable organization's EIN, you can check the IRS Tax Exempt Organization Search tool. You may also be able to hire an online company to do the.

You can find an employer identification number using the IRS notice generated when you applied for it, with banks or creditors you used it to open accounts at. EDGAR is an online database that is free for anyone to use. Search for a company in the database, then click on the filing link. The EIN typically appears in. Where Do I Find My EIN If It's Lost? · Find the notice you received from the IRS when you applied for your EIN. · Contact the financial institutions where you've. Steps to Check Your Status · Before starting, locate your order number from your application · From the GovDocFiling website, click the “Check Order Status” link. IRS does not show your EIN on any of their websites (maybe transcripts but otherwise, not publicly listed). You need to get this from your EIN letter. If yes, there is a lot to know what is an EIN number. This way, you can answer this question, “What can I do with my EIN.” As an employer who is going to start. by keeping your SSN private from business finances. Get My EIN from $79 · Call Answer a few simple questions about your business in a secure online. Each of these tax documents should have your EIN listed at the top of the first page. If you don't have any tax returns or relevant paperwork on hand that has. New business owners should submit the appropriate business registration application to obtain an account ID number. The account ID number is required to. What If I Misplaced My EIN? · Find the computer-generated notice that was issued by the IRS when you applied for your EIN. · If you used your EIN to open a bank. The best place to look your employer's EIN (Employer Identification Number) or Tax ID is in Box b of your W-2 form. Look for a 9-digit number. You can ask the company's payroll or accounting department who would know the company's tax ID. innosvet74.ru for the SEC filings of the company at. number online. Once you fill out the required information in our easy-to How do I find out my EIN number? What does having an EIN number mean? Does. Can I Look Up My EIN Online? If your company is public, you can find your EIN online on the SEC's website. When you search for your company name, look at the. How Online Registration Works You may be required to obtain a Federal Employer Identification Number (FEIN). The FEIN is issued by the Internal Revenue. You will need to apply for an EIN when registering your business online through the One Stop Business Portal as part of the online registration process. Go to the IRS website and click on "Employer Identification Number" located in the FILE tab in the menu. Even though we are covering most of the important. If you got your EIN Number online, you can download the CP online; If I received my EIN but I can't find the letter I Know my number but I need. Applying for an EIN is a free service offered by the Internal Revenue Service. Businesses can apply for an EIN by phone, fax, mail, or online. If you have used your EIN number to open bank accounts, applied for loans, or for filing state and local business licenses then you will find the tax ID number.

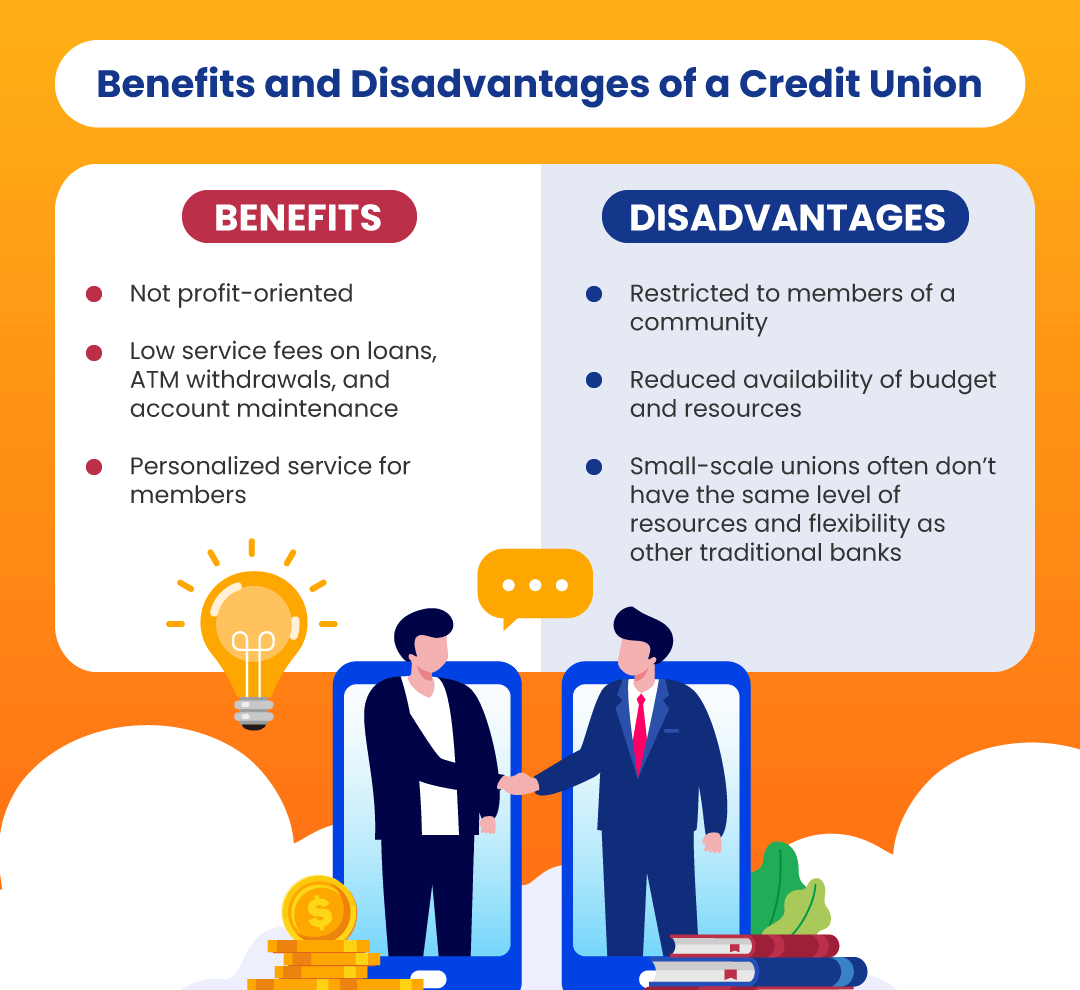

Benefit Of Credit Union Vs Bank

Credit Union VS. Bank Interest Rates and Fees Generally speaking, credit unions offer higher dividend rates and lower loan rates. This means your savings will. A credit union operates with the same level of regulations and deposit insurance just like a traditional bank. But the largest difference is who credit unions. The main difference between banks and credit unions is in their structure. Banks are purely for profit, while credit unions are member-owned. At Credit Unions, you're a member, not just a customer. One of the benefits of a credit union is that each member is also a part-owner. · At banks you are simply. In many cases, credit unions will offer significantly lower interest rates on lending products than banks that are trying to turn a profit, but higher rates on. Credit Union vs Bank ; Fees, Credit union fees typically are fewer and lower than bank fees. Fees account for nearly one-third of banks' total profits ; Safety. Credit unions tend to offer lower rates and better customer service compared to banks who may provide more products and services, but their fees, rates, and. This means credit union members can use the services of other credit unions for free, all across the U.S. and in a few participating countries. And most credit. A bank and a credit union such as Wailuku Federal Credit Union differ in several important ways, including their basic mission, structure, and relationship to. Credit Union VS. Bank Interest Rates and Fees Generally speaking, credit unions offer higher dividend rates and lower loan rates. This means your savings will. A credit union operates with the same level of regulations and deposit insurance just like a traditional bank. But the largest difference is who credit unions. The main difference between banks and credit unions is in their structure. Banks are purely for profit, while credit unions are member-owned. At Credit Unions, you're a member, not just a customer. One of the benefits of a credit union is that each member is also a part-owner. · At banks you are simply. In many cases, credit unions will offer significantly lower interest rates on lending products than banks that are trying to turn a profit, but higher rates on. Credit Union vs Bank ; Fees, Credit union fees typically are fewer and lower than bank fees. Fees account for nearly one-third of banks' total profits ; Safety. Credit unions tend to offer lower rates and better customer service compared to banks who may provide more products and services, but their fees, rates, and. This means credit union members can use the services of other credit unions for free, all across the U.S. and in a few participating countries. And most credit. A bank and a credit union such as Wailuku Federal Credit Union differ in several important ways, including their basic mission, structure, and relationship to.

Credit Union vs Bank ; Fees, Credit union fees typically are fewer and lower than bank fees. Fees account for nearly one-third of banks' total profits ; Safety. Benefits of Credit Unions - How are They Different? · Being not-for-profit, credit unions' earnings are paid back to members; they receive higher savings rates. The main difference between banks and credit unions is in their structure. Banks are purely for profit, while credit unions are member-owned. Credit unions tend to offer lower rates and fees as well as more personalized customer service. However, banks may offer more variety in loans and other. Higher savings rates: On average, you'll find better interest rates at credit unions than banks, though some high-yield accounts at banks rank at the top of the. Lower Fees and Better Rates: Credit unions typically offer lower fees and better interest rates on loans, savings accounts, and other financial. Credit unions on average charge nearly $ less for non-sufficient fund (NSF) fees than do banks; $ compared with $ They take the financial services of a bank and combine them with the philosophy of “People Helping People.” Just like banks, credit unions accept deposits, make. You can earn competitive dividends and pay lower fees at a credit union vs. a bank. Worried about paying too much in fees? Want to earn more on your savings? It. Advantages of credit unions · Better interest rates: Whether you're seeking savings accounts or loans, credit unions typically offer better rates because they. Higher savings rates: On average, you'll find better interest rates at credit unions than banks, though some high-yield accounts at banks rank at the top of the. How is a credit union different than a bank? Credit unions are not-for-profit organizations that exist to serve their members. Like banks, credit unions. Once operating expenses are met, credit unions return profits to you and other members in the form of higher interest on savings, lower interest rates on loans. A credit union is a not-for-profit, cooperative financial institution focused solely on its members. Credit unions provide the same services as most banks. Benefits of Choosing a Credit Union · Higher Savings Rates · Lower Interest Rates · Lower Fees · Better Customer Service · More Lenient on Credit History. Credit unions distribute earnings back to Members in the form of higher savings rates, lower loan rates and fees, and enhanced products and services. Banks. Bank: Banks are for-profit corporations. They aim to maximize profit and those profits go to shareholders. NCUA vs. FDIC. Credit Union: The National Credit. What's the difference between a credit union's member and a bank's customer? A major difference between banks and credit unions comes down to who owns the. Benefits of Choosing a Credit Union · Higher Savings Rates · Lower Interest Rates · Lower Fees · Better Customer Service · More Lenient on Credit History. Banks are operated for profit and are usually owned by investors. Business decisions might be made to benefit shareholders. In contrast, credit unions are not-.

Vanguard Total Corporate Bond Etf

The Fund is a fund of funds and employs an investment approach designed to track the performance of the Bloomberg Barclays US Corporate Bond Index. Latest Vanguard Total Corporate Bond ETF News: View VTC news and discuss market sentiment with the investor community on innosvet74.ru The fund is a fund of funds and employs an indexing investment approach designed to track the performance of the Bloomberg US Corporate Bond Index. The fund invests in taxable investment-grade corporate, U.S. Treasury, mortgage-backed, and asset-backed securities with short. What are the documents required to start investing in Vanguard Total Corporate Bond Etf stocks? plus_minus_icon. What is today's traded volume of Vanguard. VTC: Vanguard Total Corporate Bond ETF. Last Price; Dividend *; Yield *; Dividend Payments *. ; $; %; Volatility *; S&P Volatility *; S&P. Product summary · Seeks to provide a high and sustainable level of current income. · Invests primarily in high-quality (investment-grade) corporate bonds. Vanguard Total Corporate Bond ETF. Summary Prospectus. November 7, Exchange-traded fund shares that are not individually redeemable and are listed. Total Corporate Bond ETF. VTC, %, %, %, %, —, % (11 Vanguard Marketing Corporation, Distributor of the Vanguard Funds. The Fund is a fund of funds and employs an investment approach designed to track the performance of the Bloomberg Barclays US Corporate Bond Index. Latest Vanguard Total Corporate Bond ETF News: View VTC news and discuss market sentiment with the investor community on innosvet74.ru The fund is a fund of funds and employs an indexing investment approach designed to track the performance of the Bloomberg US Corporate Bond Index. The fund invests in taxable investment-grade corporate, U.S. Treasury, mortgage-backed, and asset-backed securities with short. What are the documents required to start investing in Vanguard Total Corporate Bond Etf stocks? plus_minus_icon. What is today's traded volume of Vanguard. VTC: Vanguard Total Corporate Bond ETF. Last Price; Dividend *; Yield *; Dividend Payments *. ; $; %; Volatility *; S&P Volatility *; S&P. Product summary · Seeks to provide a high and sustainable level of current income. · Invests primarily in high-quality (investment-grade) corporate bonds. Vanguard Total Corporate Bond ETF. Summary Prospectus. November 7, Exchange-traded fund shares that are not individually redeemable and are listed. Total Corporate Bond ETF. VTC, %, %, %, %, —, % (11 Vanguard Marketing Corporation, Distributor of the Vanguard Funds.

The fund is structured as an ETF of ETFs, investing directly in two Vanguard building-block bond ETFs: Vanguard Total Bond Market ETF (BND) and Vanguard Total. The investment seeks to track the performance of the Bloomberg U.S. Corporate Bond innosvet74.ru fund is a fund of funds and employs an indexing investment. Vanguard Total Corporate Bond ETF. This ETF provides exposure to Investment Grade Corporate Bonds Read more. Price. USD. NAV per share on 11/07/ Vanguard Total Corporate Bond ETF seeks to track the performance of a broad, market-weighted corporate bond index. The Fund is a fund of funds and employs. VTC Portfolio - Learn more about the Vanguard Total Corporate Bond ETF investment portfolio including asset allocation, stock style, stock holdings and. Can I buy Vanguard Total Corporate Bond ETF (VTC) shares? Yes, Indian investors can buy Vanguard Total Corporate Bond ETF (VTC) in the US stock market by. BulletVanguard Institutional Total Bond Market Index Trust (since 02/22/); BulletVanguard Total Corporate Bond ETF ETF Shares (since 11/07/); Bullet. Vanguard Short-Term Corporate Bond Idx Fd ETF. $ VCSH %. Vanguard Intermediate-Term Corp Bond Idx Fund ETF. $ VCIT %. See the company profile for Vanguard Total Corporate Bond ETF ETF Shares (VTC) including business summary, industry/sector information, number of employees. Get Vanguard Total Corporate Bond ETF ETF Shares (VTC:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Vanguard Corporate Bond ETFs seek to track the wide spectrum of debt securities issued by companies. This can include short-, intermediate- and long-term. Seeks to provide a moderate and sustainable level of current income. · Invests primarily in high-quality (investment-grade) corporate bonds. · Moderate interest. Affordable access to investment-grade corporate bonds. Summary We have qualitatively reviewed this strategy and reaffirmed its Above Average Process and People. In depth view into VTC (Vanguard Total Corporate Bond ETF) including performance, dividend history, holdings and portfolio stats. Explore VTC for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. Vanguard today filed a registration statement with the Securities and Exchange Commission for a new index portfolio, Vanguard Total Corporate Bond ETF. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for Vanguard Total Corporate Bond ETF (VTC). Gain valuable insights from. View Vanguard Total Corporate Bond Etf (VTC) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Complete Vanguard Total Corporate Bond ETF funds overview by Barron's. View the VTC funds market news. Get comprehensive information about Vanguard Total Corporate Bond ETF (USD) (USC) - quotes, charts, historical data, and more for informed.

Asset Location Strategy

- In a world of pure buy-and-hold and no turnover or dividends, asset location strategies are relatively straightforward to implement: equities eligible for. There is a lot written about investment withdrawal strategies that can help people save money on taxes. This can get complicated quickly and usually centers on. Asset location seeks to minimize taxes by placing different asset classes in specific tax buckets (taxable, pre-tax, tax-free). The first strategy gives priority to holding equities, through equity mutual funds, in a saver's tax-deferred account, while the second strategy gives priority. Asset location is a strategy in which investors attempt to enhance after-tax returns by carefully considering the tax treatment and future expected returns of. But as our Global Diversification Week comes to a close, there is one more item to talk about: asset location -- essentially, the placement of investments in. Asset location is a tax-minimizing strategy that requires allocating different investments into accounts with different tax treatments. Determining your asset allocation (% stocks / % bonds), which sets your portfolio's level of acceptable risk, is the single most influential decision you can. This strategy is the placement of your investments into account types to work to your advantage. The goal is to maximize after-tax earnings over time. - In a world of pure buy-and-hold and no turnover or dividends, asset location strategies are relatively straightforward to implement: equities eligible for. There is a lot written about investment withdrawal strategies that can help people save money on taxes. This can get complicated quickly and usually centers on. Asset location seeks to minimize taxes by placing different asset classes in specific tax buckets (taxable, pre-tax, tax-free). The first strategy gives priority to holding equities, through equity mutual funds, in a saver's tax-deferred account, while the second strategy gives priority. Asset location is a strategy in which investors attempt to enhance after-tax returns by carefully considering the tax treatment and future expected returns of. But as our Global Diversification Week comes to a close, there is one more item to talk about: asset location -- essentially, the placement of investments in. Asset location is a tax-minimizing strategy that requires allocating different investments into accounts with different tax treatments. Determining your asset allocation (% stocks / % bonds), which sets your portfolio's level of acceptable risk, is the single most influential decision you can. This strategy is the placement of your investments into account types to work to your advantage. The goal is to maximize after-tax earnings over time.

Asset location strategy is the positioning of assets in accounts according to tax-efficiency. Basically, most tax-inefficient assets go in. Asset location is easily ignored by simply buying the same investments in each account. For example, if I decide that a stocks:bonds asset allocation. If you have money in both taxable and tax-deferred accounts, then an asset location strategy may be right for you when it comes to optimizing your after-tax. Asset location is a tax management strategy that involves placing your investments in the right types of accounts to help maximize tax efficiencies. The goal is. Effective asset location is primarily a function of two factors: an investment's tax-efficiency, and its expected return. Investments that are high-return. Generally, it's best to implement a strategy that takes asset location into consideration gradually, rather than all at once. There are immediate tax. Asset location refers to where you will hold various types of assets across your taxable, tax-deferred and Roth accounts. Asset location is the concept of placing the asset classes in your portfolio strategically, based on the tax treatment of the accounts you're using. Asset location refers to where you will hold various types of assets across your taxable, tax-deferred and Roth accounts. Asset location and asset allocation work hand-in We call this tax bracket planning – a strategy we employ to get our clients to think about the tax. Asset location is important because investment returns are taxed differently, depending on what type of income you generate and where you earn it. Over at “Nerd's Eye View,” Michael Kitces points to a Morningstar analysis showing that a well-executed asset location strategy can add as much as a half. Asset location refers to the strategic placement of financial assets within the appropriate type of account to minimize income taxes and thus increase the. Asset location is a tax minimization strategy that takes advantage of the fact that different types of investments are taxed differently. Asset location is an investing strategy that has the potential to lower your clients' overall tax bill. There are taxable, tax-deferred, and tax-exempt. Creating an Asset-Location Strategy There are two basic steps to helping clients manage taxes through asset location: One good way to begin the. The first strategy gives priority to holding equities, through equity mutual funds, in a saver's tax-deferred account, while the second strategy gives priority. Asset location refers to the strategic placement of investments in different types of accounts based on their tax characteristics. By placing investments in the. The problem with comparing various asset location strategies through the lens of pre-tax asset allocation is that it provides a poor framework for comparing. This is the premise of asset location. You ideally want your assets spread out between different tax styles of accounts. I heard an advisor describe this to a.

Cost Of Mutual Funds

Exchange-Traded Funds (ETFs) · Trade Commission (online) · Understanding ETF costs. Your broker may charge you a trade commission each time you buy or sell an. Herein lies another advantage of mutual funds: the legal requirement for complete disclosure of all fees. A mutual fund's fees and expenses are explained in the. Admiral Shares · $3, for most index funds. · $50, for most actively managed funds. · $, for certain sector-specific index funds. Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of. These fees and charges are identified in the fee table, located near the front of a fund's prospectus, under the heading "Shareholder Fees.". 1. Management expense ratio. An MER is the fee charged to manage the money invested in a mutual fund. It is the total of a fund's management fee, operating. Learn about the cost differences, including loads, expense ratios, and 12b-1 fees, between ETFs and mutual funds. Transaction fees are charged each time you enter into a transaction, for example, when you buy a stock or mutual fund. In contrast, ongoing fees or expenses are. All mutual funds have fees, with some charged at specific times, based on actions you take, and some are charged on an ongoing basis. Each fund's prospectus. Exchange-Traded Funds (ETFs) · Trade Commission (online) · Understanding ETF costs. Your broker may charge you a trade commission each time you buy or sell an. Herein lies another advantage of mutual funds: the legal requirement for complete disclosure of all fees. A mutual fund's fees and expenses are explained in the. Admiral Shares · $3, for most index funds. · $50, for most actively managed funds. · $, for certain sector-specific index funds. Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of. These fees and charges are identified in the fee table, located near the front of a fund's prospectus, under the heading "Shareholder Fees.". 1. Management expense ratio. An MER is the fee charged to manage the money invested in a mutual fund. It is the total of a fund's management fee, operating. Learn about the cost differences, including loads, expense ratios, and 12b-1 fees, between ETFs and mutual funds. Transaction fees are charged each time you enter into a transaction, for example, when you buy a stock or mutual fund. In contrast, ongoing fees or expenses are. All mutual funds have fees, with some charged at specific times, based on actions you take, and some are charged on an ongoing basis. Each fund's prospectus.

Understand the Cost of Mutual Funds · Management Fees: These include portfolio management fees and trailing commissions. · Operating Costs: These cover the. Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of. The company managing the mutual fund will often pay a trailing commission (or trailer fee). This commission is for services and the advice provided to you. The asset-weighted OER ratio for actively managed mutual funds is %.3 OERs can range from % – %. From to , average equity mutual fund expense ratios dropped by 60 percent and average bond mutual fund expense ratios dropped by. 56 percent.» In Admiral Shares · $3, for most index funds. · $50, for most actively managed funds. · $, for certain sector-specific index funds. The amount of mutual fund expense ratios varies greatly. An index fund could have an expense ratio of % or lower, while some actively managed specialty funds. As each fund passes its fiscal year-end, the annual expense ratio is calculated by dividing the fund's operational expenses by its average net assets. If the. That's because mutual funds have share classes that charge different fees depending on the type of investor, particularly whether the shares are held by. Amana Mutual Funds · Investor (AMDWX), Institutional (AMIDX) ; Management Fees · %, % ; Distribution (12b-1) Fees · %, % ; Other Expenses, %, Annual fund operating expenses · Class S Shares. Gross: % – %; Net: % – % · Class A Shares. Gross: % – %; Net: % – % · Some. Generally, for an actively managed fund, good expense ratios range between % and %. Anything above % is considered high. What Has the Lowest Expense. Mutual fund fees and expenses Mutual fund fees and expenses are charges that may be incurred by investors who hold mutual funds. Operating a mutual fund. The Real Cost Of Owning A Mutual Fund · Expense Ratio. The expense ratio may be the only cost that some investors believe they pay when owning a mutual fund. 1. Management expense ratio. An MER is the fee charged to manage the money invested in a mutual fund. It is the total of a fund's management fee, operating. In other words, for every $10, of investment you are paying $ in mutual fund fees every year. If you have the average account balance for a median-sized. mutual fund in terms of cost and account value. For example, within a brokerage account, compare owning an A-share to a C-share of XYZ Fund. The account and. The Securities and Exchange Commission (SEC) paid little attention to fees until , when it commissioned the Wharton School to study price competition among. Calculate the impact of fees ·? Investment amount: X. Investment amount ·? Rate of return: X. Rate of return ·? Holding period: X. Holding period ·? Sales. 12b-1 fees can sometimes be included in a mutual fund's expense ratio. This is an additional expense used to cover the distribution and marketing of mutual fund.

How To Invest In Real Estate Etf

Some investors may want to invest in an exchange-traded fund or mutual fund that tracks a broad-based REIT index rather than investing in individual REITs. Global Real Estate ETFs invest in real estate companies from all over the world. These ETFs can offer broad exposure to the industry, or can target specific. REIT investing can be a good addition to a diversified portfolio. Learn about 5 types of REITs and the pros and cons to make a smart investment decision. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may. Why NBGR? Differentiated Process. Proprietary investment approach that incorporates both top-down macroeconomic analysis and bottom-up. To buy fractional shares of Real Estate Tycoon (Vanguard Real Estate ETF) stock, you'll need to sign up for Stash and open a personal portfolio. I'd recommend just investing in an SP index fund if you have no plans to buy real estate yourself. investing principally in equity real estate investment trusts (REITs). Portfolio management generally conducts a security and portfolio evaluation monthly. 40 ETFs are placed in the Real Estate Category. Click to see Returns, Expenses, Dividends, Holdings, Taxes, Technicals and more. Some investors may want to invest in an exchange-traded fund or mutual fund that tracks a broad-based REIT index rather than investing in individual REITs. Global Real Estate ETFs invest in real estate companies from all over the world. These ETFs can offer broad exposure to the industry, or can target specific. REIT investing can be a good addition to a diversified portfolio. Learn about 5 types of REITs and the pros and cons to make a smart investment decision. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may. Why NBGR? Differentiated Process. Proprietary investment approach that incorporates both top-down macroeconomic analysis and bottom-up. To buy fractional shares of Real Estate Tycoon (Vanguard Real Estate ETF) stock, you'll need to sign up for Stash and open a personal portfolio. I'd recommend just investing in an SP index fund if you have no plans to buy real estate yourself. investing principally in equity real estate investment trusts (REITs). Portfolio management generally conducts a security and portfolio evaluation monthly. 40 ETFs are placed in the Real Estate Category. Click to see Returns, Expenses, Dividends, Holdings, Taxes, Technicals and more.

Research stocks, ETFs, and mutual funds in the Real Estate Sector. We offer more than sector mutual funds and sector ETFs from other leading asset. REAI is an actively managed exchange-traded fund that seeks to achieve its investment objective of total return by investing in publicly traded real estate. The Real Estate Fund Invests in a Wide Range of Sectors. The VanEck Global Real Estate UCITS ETF is diversified across real estate companies from six real. Invest in DCRE If you don't see your brokerage listed here, search for DCRE on your brokerage of choice. Email your financial professional to discuss the. Learn how to invest in REITs through stocks, funds, ETFs & retirement plans. Get info on allocations, valuation, earnings & performance tracking today. Find fund benefits, investment approach, performance and portfolio details for Columbia Research Real Estate ETF (CRED). Real Estate Funds and ETFs invest primarily in securities offered by public real estate companies, including commercial and corporate properties. Provides exposure to real estate securities focused on income derived from real estate investments and structured in a similar way as real estate investment. track as closely as possible, before fees and expenses, the total return of an index composed of U.S. real estate investment trusts classified as equities. Assets: REITs purchase and operate properties directly. REIT ETFs invest in shares of publicly traded REITs. In short, REITs buy properties. REIT ETFs buy. Real Estate ETFs in comparison ; VanEck Global Real Estate UCITS ETFNL, , % p.a. ; Amundi Index FTSE EPRA NAREIT Global UCITS ETF DRLU Vanguard Real Estate ETF (VNQ): $ billion in assets under management, % in annual expenses, % yield · Schwab U.S. REIT ETF · Real Estate Select. Investing in real estate with ETFs can provide investors with diversification, lower fees, liquidity, lower risk, growth potential and income generation. 1. Exposure to the U.S. residential real estate sector · 2. Targeted access to a subset of domestic real estate stocks and real estate investment trusts (REITs). Real Estate ETF List: 61 ETFs ; VNQI, Vanguard Global ex-U.S. Real Estate ETF, Vanguard ; USRT, iShares Core U.S. REIT ETF, Blackrock ; ICF, iShares Cohen & Steers. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may. In conclusion, choosing between investing in real estate or stocks and ETFs comes down to individual circumstances and preferences. Stocks and ETFs offer. 1. Low cost access to diversified U.S. REITs (Real Estate Investment Trusts) · 2. Seek income and growth with broad exposure to U.S. real estate across property. REIT ETFs. Vanguard Real Estate ETF (innosvet74.ru) seeks to provide high income and moderate long-term capital growth by investing in stocks issued by commercial. Another public, liquid way to invest in REITs is through ETFs (exchange traded funds). REIT ETFs, such as the Vanguard REIT ETF, invest in several public REITs.

Real Estate Investing Reviews

Bottom line. If you're searching for a fixed-income investment with less risk than traditional real estate investing, Concreit could be what you're looking for. I've had positive and negative experiences with real estate investing. Early on, when I didn't know what I was doing, it was largely negative. This book is very informative. It gives a good idea of the ton of upfront work it takes to be a successful real estate investor by giving you a repeatable “. The #1 Real Estate Investing App Welcome to the real estate investor's marketplace + community Inside you can also review how-to articles & access house. This $20k program is a danger to any individual who comes in knowing nothing about real estate and relies on ***** to teach them everything they need to know. From experts in real estate investing, to the most robust tips to get started and grow your wealth, Clayton really covers it all. The best real estate investing concept. Roots is the single best real estate investment concept I've ever seen. Investors, renters, and the city of Atlanta all. If you follow the principles of a successful real estate investor, real estate investing is ALWAYS a good investment, regardless of the cyclical. Real estate crowdfunding thrives in the online space. This set-up is ideal for those who are willing to invest a small amount to become shareholders or partial. Bottom line. If you're searching for a fixed-income investment with less risk than traditional real estate investing, Concreit could be what you're looking for. I've had positive and negative experiences with real estate investing. Early on, when I didn't know what I was doing, it was largely negative. This book is very informative. It gives a good idea of the ton of upfront work it takes to be a successful real estate investor by giving you a repeatable “. The #1 Real Estate Investing App Welcome to the real estate investor's marketplace + community Inside you can also review how-to articles & access house. This $20k program is a danger to any individual who comes in knowing nothing about real estate and relies on ***** to teach them everything they need to know. From experts in real estate investing, to the most robust tips to get started and grow your wealth, Clayton really covers it all. The best real estate investing concept. Roots is the single best real estate investment concept I've ever seen. Investors, renters, and the city of Atlanta all. If you follow the principles of a successful real estate investor, real estate investing is ALWAYS a good investment, regardless of the cyclical. Real estate crowdfunding thrives in the online space. This set-up is ideal for those who are willing to invest a small amount to become shareholders or partial.

Looking to learn real estate investing? Why not learn from people who are actually full-time real estate investors. The Realinvestors Academy, LLC is. Cadre Fees and Cost. Cadre does not have an upfront cost for joining the platform, but there are a few fees when you invest. You pay 1% of your gross invested. Customers find the book very readable, intuitive, and clear. They also describe it as a gem for real estate that provides an enormous return on investment. What makes Arrived appealing to investors is that it's completely passive. Once funding is complete, Arrived takes over all aspects of property management. This. You buy 2 properties with 50k down. The down payment is 20% for investment, means that you have 2 properties for k each. Means total k real estate value. From experts in real estate investing, to the most robust tips to get started and grow your wealth, Clayton really covers it all. This book is not only a must read for all real estate investors (especially beginners) it is worth reading again and again. As of this review I have read this. Fundrise is a real estate investment platform that offers access to a variety of assets, ranging from single-family homes to commercial real estate projects. Others prefer "active" real estate investing, where they actually own and manage properties themselves, develop projects ground up, or flip properties. There. At Goodegg Investments® we take the burden out of investing in real estate so you get all the benefits with none of the hassles of being a landlord. Review past projects and research the construction company's reputation for new investments. · Review property deeds, recent surveys, and appraisal reports for. Investing in real estate is one of the most common and reliable forms of investment. It can be a great idea provided that all the risks are appropriately. Issuers submit real estate opportunities to the addy platform. Step 2. Exempt market dealer partners review and approve investment opportunities for. Patrick with 30+ years of experience in residential real estate and multifamily property investment can get you quickly up to speed with Ottawa's landscape. Investing in real estate can be intimidating. It can be costly to get started. Dealing with the matrix of taxes, rent, and property maintenance can scare. Investing in real estate diversifies portfolios and can protect against market volatility. Options like REITs offer easy entry into real estate without the. BBB accredited since 7/25/ Real ETX Investing in Dallas, TX. See BBB rating, reviews, complaints, get a quote & more. The real estate investment trust (REIT) that creates wealth for its investors and its renters. Commercially motivated, Community inspired®. 1. Property Location · 2. Valuation of the Property · 3. Investment Purpose and Investment Horizon · 4. Expected Cash Flows and Profit Opportunities · 5. Be Careful. Higher Returns: Gain access to higher-yielding real estate deals than you could individually or on other reputable sites. · Hands Off Investing: · Supplemental.

Beginning Game Design

About this course · Game Design: Take an idea to a full design ready for developers and asset creators · Gameplay Development: Understand the inner workings of an. If you already have a clear plan for the game, you can begin character design. Start by creating simple characters that you can improve later. For instance, you. Learn how to create your video games. In this article, we will give an ultimate tutorial for beginners to learn game development. A bachelor's degree in software engineering is an ideal place to start if you want to become a video game designer. This type of degree program will give you. Gain foundational knowledge in the video game development process. In this course, you will learn: Game Design: Take an idea to a full design ready for. Design the world, or structure, of the game. Once you have the key art figured out, start constructing the assets for the game world. Depending on the style of. If you are interested in a career in technology but also want a creative outlet, Game Design might be the field for you. Learn how to build a game from the. Mod games – This is a very effective practicing tool, especially for content design. You're essentially using same native development tools a the game devs use. Video games are multi-disciplinary. You need at least game design, art, programming, and audio skills to create a simple game. If you don't have. About this course · Game Design: Take an idea to a full design ready for developers and asset creators · Gameplay Development: Understand the inner workings of an. If you already have a clear plan for the game, you can begin character design. Start by creating simple characters that you can improve later. For instance, you. Learn how to create your video games. In this article, we will give an ultimate tutorial for beginners to learn game development. A bachelor's degree in software engineering is an ideal place to start if you want to become a video game designer. This type of degree program will give you. Gain foundational knowledge in the video game development process. In this course, you will learn: Game Design: Take an idea to a full design ready for. Design the world, or structure, of the game. Once you have the key art figured out, start constructing the assets for the game world. Depending on the style of. If you are interested in a career in technology but also want a creative outlet, Game Design might be the field for you. Learn how to build a game from the. Mod games – This is a very effective practicing tool, especially for content design. You're essentially using same native development tools a the game devs use. Video games are multi-disciplinary. You need at least game design, art, programming, and audio skills to create a simple game. If you don't have.

Beginning Game Development with Godot: Learn to Create and Publish Your First 2D Platform Game [Dhule, Maithili] on innosvet74.ru Video game designers need at least a high school diploma or equivalent. When in high school, it's helpful to take computer coding and graphic design classes if. Make games. There are many engines that require minimal to no coding. Something like game maker can be a good beginning. Unity and Unreal have. % learn to develop first. Learn to code, how to create art assets, implement scripting, how to track your development with proper tools, etc. The most common way to develop a game is by building it with an already existing game engine. Both the Unity and Unreal engines are versatile enough to allow. Gameplay Development: Understand the inner workings of an engaging game, such as gameplay mechanics, artificial intelligence, and user experience; Game Assets. Game design refers to the conceptual side of things: the initial vision, the mechanics, the story, the characters, the locations, and so on. · Game development. This article is the first of a two-part series covering theories behind level design, establishing some rules for level creation. Part of developing and designing games includes prototyping, testing, and creative problem-solving to ensure that the game functions properly. Teamwork is also. What is game development for kids? Game development is the process of making a video game - from the start of an idea to the end where it is ready for others. History · Space Invaders, marking the beginning of the golden age of arcade video games and inspiring dozens of manufacturers to enter the market. · Zork. This course focuses on the conceptual underpinnings of games, and all assignments can be completed with a pencil and paper – no previous programming knowledge. Some game designers start by earning a bachelor's degree in video game design, computer science, or a related field. Other designers teach themselves or enroll. Beginning Game Development with Godot: Learn to Create and Publish Your First 2D Platform Game [Dhule, Maithili] on innosvet74.ru Game developers need a blend of creative and technical skills, involving design, coding, and testing to bring interactive video games to life. The big 3 in games are art, engineering and design. The support teams around that are production, qa, audio, and infrastructure. So step 1 is. Transform a love for gaming into valuable STEAM skills. Chart your child's future success with our inclusive virtual classes, curriculum. The game concept is established during pre-production. This is also where you'll outline development and design requirements. And you'll plan how this game will. A game's coding language is chosen following the development of the game's initial design. beginning game design. Explore free game engines, sound software. Concept. The concept stage is where the initial idea for the game is formed. · Planning. During the planning stage, a game designer creates a detailed plan for.