innosvet74.ru

Community

Central Bank Digital Currency Uk

“We took evidence from a variety of witnesses and none of them were able to give us a compelling reason for why the UK needed a central bank digital currency. Bank of England's Discussion Paper: Central Bank Digital Currency: Opportunities, challenges and design · The Central Bank of Sweden (Riksbank) has published its. A CBDC is virtual money created by a central bank. As cryptocurrencies and stablecoins become popular, central banks provide alternatives. A UK digital currency could make the payments side of the UK banking system more resilient and competitive. It could also improve the efficiency of cross-border. While many of the current studies on central bank digital currencies (CBDCs) focus on the preferences of central banks (the “push”), our survey explores the. The Bank of England has already posed questions about the potential of digital cash, or 'central bank digital currency', prompted by the ongoing rise of. A centralised bank digital currency (or CBDC) is a “new form of digital money” issued by a central bank instead of a commercial bank. In this case, it is the. In simple terms, a central bank digital currency (CBDC) would be a digital banknote. It could be used by individuals to pay businesses, shops or each other. We are committed to working with central banks across all key stages of enabling CBDCs & supporting new digital currency payments on our network securely. “We took evidence from a variety of witnesses and none of them were able to give us a compelling reason for why the UK needed a central bank digital currency. Bank of England's Discussion Paper: Central Bank Digital Currency: Opportunities, challenges and design · The Central Bank of Sweden (Riksbank) has published its. A CBDC is virtual money created by a central bank. As cryptocurrencies and stablecoins become popular, central banks provide alternatives. A UK digital currency could make the payments side of the UK banking system more resilient and competitive. It could also improve the efficiency of cross-border. While many of the current studies on central bank digital currencies (CBDCs) focus on the preferences of central banks (the “push”), our survey explores the. The Bank of England has already posed questions about the potential of digital cash, or 'central bank digital currency', prompted by the ongoing rise of. A centralised bank digital currency (or CBDC) is a “new form of digital money” issued by a central bank instead of a commercial bank. In this case, it is the. In simple terms, a central bank digital currency (CBDC) would be a digital banknote. It could be used by individuals to pay businesses, shops or each other. We are committed to working with central banks across all key stages of enabling CBDCs & supporting new digital currency payments on our network securely.

Central Bank Digital Currency (CDBC)Permalink You may be familiar with or heard of digital currency. Bitcoin is an example of a digital currency that has been. UK digital pound. The Bank of England's announced its interest in CBDC when it published a discussion paper in July In February the Bank of. A CBDC is an electronic form of central bank money with potential wide use by households and businesses to store value and make payments. It's central bank. According to the IMF, the BoE is one of more than half the world's central banks actively exploring or developing central bank digital currencies (CBDCs). Not to be confused with Stablecoin. A central bank digital currency (CBDC; also called digital fiat currency or digital base money). enhance the benefits of, central bank money in the form of Central Bank Digital Currencies (CBDCs). Under the UK presidency, we have been working together to. Today in the United States, Federal Reserve notes (i.e., physical currency) are the only type of central bank money available to the general public. Like. enhance the benefits of, central bank money in the form of Central Bank Digital Currencies (CBDCs). Under the UK presidency, we have been working together to. Central bank digital currencies (CBDC) can deliver a more efficient, faster and safer financial system by providing another alternative to cash and bank. With the digital pound, the UK is following much of what the European Central Bank has done on the digital euro. But could the UK's more unified banking sector. It's central bank digital money in the national unit (e.g., the US dollar) representing legal tender with the liability of the central bank, similar to physical. Britcoin refers to the initiative in the U.K. for a digital pound that A central bank digital currency (CBDC) is the digital form of a country's. Central banks are currently considering the potential utility of Central Bank Digital Currencies (CBDCs). Some central banks have already started issuing CBDCs. CBDCs are created by a central bank and designed based on a country's unique policy objectives and motivations. For instance, CBDCs may be used in government. The Bank of England's proposed retail Central Bank Digital Currency (CBDC) could be a catalyst in payment innovation within the UK's financial system. Even money can "change its skin" and one of the phenomena that could lead to a change is that of Central Bank Digital Currency (CBDC), a new form of money. Digital money can either be centralized, where there is a central point of control over the money supply (for instance, a bank), or decentralized, where the. Central Bank Digital Currency (CDBC)Permalink You may be familiar with or heard of digital currency. Bitcoin is an example of a digital currency that has been. Central banks issue CBDCs as a digital version of their country's government-backed conventional fiat currency. Unlike cryptocurrencies, CBDCs are centralized.

Dti How Much House Can I Afford

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2, per month and your monthly. Your bank will then find the highest mortgage you can afford without increasing your debt-to-income ratio (DTI) beyond the limit. The maximum DTI for. Part of calculating mortgage affordability includes knowing your debt-to-income ratio or DTI. Your DTI is determined by your total monthly debt compared to your. This range will help you figure out what you can afford and also helps lenders determine your approval status for a mortgage loan. A DTI score of 36% or less is. House Affordability. In the United States, lenders use DTI to qualify home-buyers. Normally, the front-end DTI/back-end DTI limits for. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. Our affordability calculator will suggest a DTI of 36% by default. You can get an estimate of your debt-to-income ratio using our DTI Calculator. Interest. According to the rule, you should spend no more than 28% of your pre-tax income on your mortgage payment and no more than 36% toward total debt obligations. How much house can I afford based on my salary? · Your DTI ratio is the main factor lenders use to determine how much they'll qualify you to borrow. · Your income. To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2, per month and your monthly. Your bank will then find the highest mortgage you can afford without increasing your debt-to-income ratio (DTI) beyond the limit. The maximum DTI for. Part of calculating mortgage affordability includes knowing your debt-to-income ratio or DTI. Your DTI is determined by your total monthly debt compared to your. This range will help you figure out what you can afford and also helps lenders determine your approval status for a mortgage loan. A DTI score of 36% or less is. House Affordability. In the United States, lenders use DTI to qualify home-buyers. Normally, the front-end DTI/back-end DTI limits for. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. Our affordability calculator will suggest a DTI of 36% by default. You can get an estimate of your debt-to-income ratio using our DTI Calculator. Interest. According to the rule, you should spend no more than 28% of your pre-tax income on your mortgage payment and no more than 36% toward total debt obligations. How much house can I afford based on my salary? · Your DTI ratio is the main factor lenders use to determine how much they'll qualify you to borrow. · Your income.

Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income. How to Determine Home Affordability · Calculate Your Debt-to-Income Ratio. Your debt-to-income (DTI) ratio is a key factor that lenders consider when figuring. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. To calculate your DTI, divide your total monthly debt payments by your gross monthly income. The resulting percentage is your debt-to-income ratio. Aim for a. Generally that's between % of gross income. There may be other factors that reduce it but that's generally where guidelines have been for. How much of a mortgage can I afford based on my income? · Start with half of your gross monthly income. · Next, add up your monthly debts. · Then, subtract your. Information regarding your debt-to-income ration (DTI) will populate automatically in the fields below. Then provide a down payment you could afford, followed. What is Debt to Income Ratio? (DTI) · (Home Affordability Calculators say this percentage should not exceed 28 percent of your income.) · For example, if your. The lower your DTI ratio, the more likely you will be able to afford a mortgage — opening up more loan options. A DTI of 20% or below is considered excellent. These home affordability calculator results are based on your debt-to-income ratio (DTI). Industry standards suggest your total debt should be 36% of your. Understand how much house you can afford. This mortgage affordability calculator provides an idea of your target purchase price, and it's based on some. A 20% DTI is easier to pay off during stressful financial periods compared to, say, a 45% DTI. Home-buyers who are unsure of which option to use can try the. A DTI ratio is your monthly expenses compared to your monthly gross income. Lenders consider monthly housing expenses as a percentage of income and total. How much home can I afford? · You could afford a home that costs up to: $, · Mortgage affordability calculator information. Remember, your DTI is based on your income before taxes - not on the amount you actually take home. Your DTI ratio is looking good Relative to your income. Lenders typically say the ideal front-end ratio should be no more than 28 percent, and the back-end ratio, including all expenses, should be 36 percent or lower. Your debt-to-income ratio (DTI) helps lenders determine if you can afford to take on additional debt, such as a mortgage loan. If your DTI is too high, you. What are some common DTI requirements? Mortgage lenders use DTI to ensure you're not being over extended with your new loan. Experts recommend having a DTI. For example, if your monthly gross income before taxes is $6, and your regular monthly payments total $3,, your DTI is 50%, and most lenders will want you.

Rerfx

American Funds Europacific Growth R5 (RERFX) is an actively managed International Equity Foreign Large Growth fund. American Funds launched the fund in Company Search Results for "Europacific" ; aMERICaN FUNDS EUROPaCIFIC GR R5 (RERFX) [MF], 1 · 0 ; American Funds Europacific Growth Fund, 25 · 29 ; american Funds. View the latest American Funds EuroPacific Growth Fund;R5 (RERFX) stock price, news, historical charts, analyst ratings and financial information from WSJ. American Funds EuroPacific Growth Fund®. Shareclass. American Funds Europacific Growth R5 (RERFX). Type RERFX. American Funds EuroPacific Growth Fund. Long term indicators fully support a continuation of the trend. The market is in highly overbought territory. Beware of a trend reversal. See More Share. RERFX. RERFX: American Funds - EuroPacific Growth Fund Class R-5 Shares - Class Information. Get the lastest Class Information for American Funds - EuroPacific. EuroPacific Growth Fund® (Class R-5 | Fund | RERFX) seeks to provide long-term growth of capital. Performance charts for EuroPacific Growth Fund (RERFX) including intraday, historical and comparison charts, technical analysis and trend lines. American Funds EuroPacific Growth Fund;R5 advanced mutual fund charts by MarketWatch. View RERFX mutual fund data and compare to other funds. American Funds Europacific Growth R5 (RERFX) is an actively managed International Equity Foreign Large Growth fund. American Funds launched the fund in Company Search Results for "Europacific" ; aMERICaN FUNDS EUROPaCIFIC GR R5 (RERFX) [MF], 1 · 0 ; American Funds Europacific Growth Fund, 25 · 29 ; american Funds. View the latest American Funds EuroPacific Growth Fund;R5 (RERFX) stock price, news, historical charts, analyst ratings and financial information from WSJ. American Funds EuroPacific Growth Fund®. Shareclass. American Funds Europacific Growth R5 (RERFX). Type RERFX. American Funds EuroPacific Growth Fund. Long term indicators fully support a continuation of the trend. The market is in highly overbought territory. Beware of a trend reversal. See More Share. RERFX. RERFX: American Funds - EuroPacific Growth Fund Class R-5 Shares - Class Information. Get the lastest Class Information for American Funds - EuroPacific. EuroPacific Growth Fund® (Class R-5 | Fund | RERFX) seeks to provide long-term growth of capital. Performance charts for EuroPacific Growth Fund (RERFX) including intraday, historical and comparison charts, technical analysis and trend lines. American Funds EuroPacific Growth Fund;R5 advanced mutual fund charts by MarketWatch. View RERFX mutual fund data and compare to other funds.

Find the latest performance data chart, historical data and news for American Funds - EuroPacific Growth Fund Class R-5 Shares (RERFX) at innosvet74.ru American Funds EuroPacific Growth Fund® RERFX has $ BILLION invested in fossil fuels, 11% of the fund. American Funds EuroPacific Growth Fund;R5 mutual fund holdings by MarketWatch. View RERFX holdings data and information to see the mutual fund assets and. CEUFX RERAX RERBX REEBX RERCX REREX RERHX RERFX RERGX. Investment objective The fund's investment objective is to provide you with long-term growth of. This page shows ETF alternatives to the RERFX mutual fund. The ETFs in the tables consist of ones that track the same index and are in the same ETFdb. See performance data and interactive charts for American Funds Europacific Growth Fd (RERFX). Research information including trailing returns and. American Funds EuroPacific Growth Fund®. Shareclass. American Funds Europacific Growth R5 (RERFX). Type American Funds EuroPacific Growth Fund® $RERFX is RERFX. American Funds EuroPacific Growth Fund® Class R Actions. Add to watchlist; Add to portfolio. Price (USD); Today's Change / %; 1 Year. Get American Funds EuroPacific Growth Fund® Class R-5 (RERFX.O) real-time stock quotes, news, price and financial information from Reuters to inform your. RERFX1. Fund. •: Foreign Large Growth1. Morningstar Category (with load). •: MSCI EAFE NR USD2. Broad-Based Index. •: RERFX Pre-Liquidation3. Fund. •: RERFX. RERFX's dividend yield, history, payout ratio & much more! innosvet74.ru: The #1 Source For Dividend Investing. RERFX: American Funds - EuroPacific Growth Fund Class R-5 Shares - Fund Profile. Get the lastest Fund Profile for American Funds - EuroPacific Growth Fund. Long term indicators fully support a continuation of the trend. The market is in highly overbought territory. Beware of a trend reversal. See More Share. RERFX. Get the latest American Funds - EuroPacific Growth Fund-5 Shares (RERFX) price, news, buy or sell recommendation, and investing advice from Wall Street. Get American Funds EuroPacific Growth Fund (RERFX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. RERFX. Share Class: Retirement. CUSIP: Inception Date: 05/15/ Investment Expenses, Sales Charges, and Fees. Annual Operating Expense. Net. Find the latest performance data chart, historical data and news for American Funds - EuroPacific Growth Fund Class R-5 Shares (RERFX) at innosvet74.ru No gun manufacturer and major gun retailer stocks found in American Funds EuroPacific Growth Fund® $RERFX. Tweet. Invest Your Values. See performance data and interactive charts for American Funds Europacific Growth Fd (RERFX). Research information including trailing returns and.

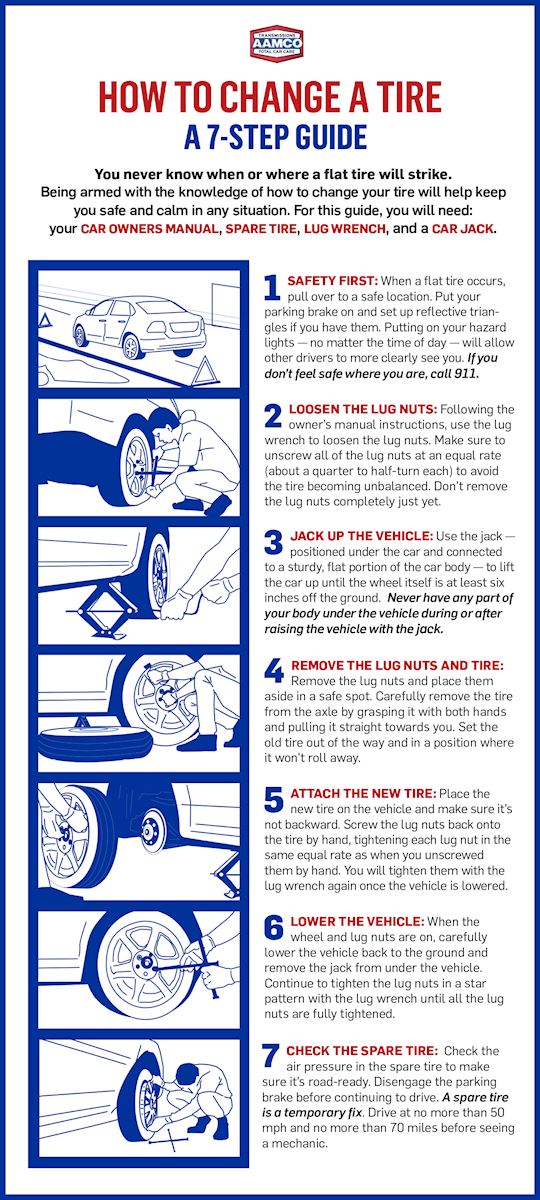

When To Replace Car Tires

"Tire Rack's advice is that if rain and wet roads are a concern, you should consider replacing your tires when they reach approximately 4/32" of remaining tread. As a general rule, the original tires on a new vehicle or quality replacement tires should last up to 50, miles. However, many factors will have a. The 1st way is knowing the age of the tires. If your tires are more than 6 years old then you should change them. If your tires are more than 6 years old then you should change them. The second way in deciding if you ought to change your tires is measuring the tread depth. But after 10 years – regardless of their condition – those tires will need a replacement. Since tires wear out over time, regular maintenance checks are. Multiple close punctures. · Damage to the sidewall or shoulders. · Damage to the tire belt. · Large punctures or cuts. · Car crash or accident impacts. The United States Department of Transportation recommends replacing tires when the tread wears down to 2/32 of an inch. Special gauges that measure tread depth. fnp93, not sure how you use the car and what tires are on it but 6mm on the tread means the front tires should be ok for a while. Once you get to 3mm of tread. Industry standards say you should replace passenger and truck/SUV tires on average at six years and before ten years of age. The timing depends significantly on. "Tire Rack's advice is that if rain and wet roads are a concern, you should consider replacing your tires when they reach approximately 4/32" of remaining tread. As a general rule, the original tires on a new vehicle or quality replacement tires should last up to 50, miles. However, many factors will have a. The 1st way is knowing the age of the tires. If your tires are more than 6 years old then you should change them. If your tires are more than 6 years old then you should change them. The second way in deciding if you ought to change your tires is measuring the tread depth. But after 10 years – regardless of their condition – those tires will need a replacement. Since tires wear out over time, regular maintenance checks are. Multiple close punctures. · Damage to the sidewall or shoulders. · Damage to the tire belt. · Large punctures or cuts. · Car crash or accident impacts. The United States Department of Transportation recommends replacing tires when the tread wears down to 2/32 of an inch. Special gauges that measure tread depth. fnp93, not sure how you use the car and what tires are on it but 6mm on the tread means the front tires should be ok for a while. Once you get to 3mm of tread. Industry standards say you should replace passenger and truck/SUV tires on average at six years and before ten years of age. The timing depends significantly on.

To determine if your car tires need replacing, examine the tread wear bars, which are the raised bridges between the treads, to see if they're flush with the. Lots of states have regulations stating that if the tread on your tires is less than 2/32 of an inch, it needs to be changed. Tire tread depth gauges can be. If your tires are more than 6 years old then you should change them. The second way in deciding if you ought to change your tires is measuring the tread depth. How To Know When To Replace Tires · Tread Wear · Bulges And Bubbles · Vibration · Sidewall Cracks · Embedded Nails Or Stones · Visible Damage · Valve Cap Damage. According to AAA, tires should be changed every five years or 60, miles. However, this does not mean every set of tires should be replaced. If the tire is greater than ten years old, it must be replaced despite the condition. Your vintage car may have extremely low miles since you just drive it on. As a general rule, the original tires on a new vehicle or quality replacement tires should last up to 50, miles. However, many factors will have a. The answer given by the U.S. Department of Transportation is applicable in all cases: tires need to be replaced when the tread depth reaches 2/32 of an inch or. If your tires are more than 10 years old, they should be replaced regardless of their condition. You might drive very few miles because you have a short commute. The rule of thumb is any tires over ten years old are no longer considered safe for use and should be replaced. The date your tire was produced can be found on. All tires (including spare tires) more than ten years old should be removed from service and replaced with new tires. Verify the physical age of any car tire by. You dont need to replace these tires. I've had dealers and tire shops starting their sales pitch at 4/32nds. Ignore them. I did replace these same tires at 15k. If the tires are over six years old then you need to change them. The second factor in determining if you ought to replace your tires is measuring the tread. If the tires are over 6 years old, then you should replace them. The second way in deciding if you ought to change your tires is measuring the tread depth. The. If you can see all of Lincoln's head, it's time to replace the tire. Penny test to measure tread. If the penny goes in enough that the tire tread is at least as. "Tire Rack's advice is that if rain and wet roads are a concern, you should consider replacing your tires when they reach approximately 4/32" of remaining tread. Tire age is another big factor for tire replacement. We recommend replacing tires aged six years or older. For your safety, we won't service tires 10 years or. How To Know When To Replace Tires · Tread Wear · Bulges And Bubbles · Vibration · Sidewall Cracks · Embedded Nails Or Stones · Visible Damage · Valve Cap Damage. This test works because National Highway Traffic Safety Administration (NHTSA) guidelines say that tires should be replaced when the tread reaches 2/32 of an. When Should You Get Your Tires Replaced? · Tread Wear · Bubbles and Bulges · Vibration · Sidewall Cracks or Cuts · Embedded nails or stones · Observable damage.

Getting A Manufactured Home Loan

You can buy a manufactured home with a loan insured by the Federal Housing Administration (FHA). These loans are available to finance the purchase of a. Showing of 8 manufactured home lenders ; Credit Human. 60 Lake St., Ste St. Albans, VT ; 21st Mortgage Corporation. Market Street. Knoxville. Our manufactured home loan at Sound Community Bank is perfect to make your dream a reality. No hidden or junk fees; Automatic payment transfers available. FHA loans are available for financing or refinancing manufactured homes with terms of up to 30 years and loans that offer low down payments and loosened credit. For manufactured homes on leased land or other properties, non-conforming manufactured home loans are available through our partner Triad Financial Services. Showing of 7 manufactured home lenders · 1st Security Bank · innosvet74.ru · Triad Financial Services · 21st Mortgage Corporation · Credit Human. What is a Manufactured Home Loan? · Purchase only · year term · Minimum credit score of · Property must have the title available or have been converted to. innosvet74.ru offers a range of personal property (chattel) financing options for Manufactured and Mobile homes. If you already own the land, you can use the land as your equity-down payment to purchase your home. SECU finances manufactured home purchases. You can buy a manufactured home with a loan insured by the Federal Housing Administration (FHA). These loans are available to finance the purchase of a. Showing of 8 manufactured home lenders ; Credit Human. 60 Lake St., Ste St. Albans, VT ; 21st Mortgage Corporation. Market Street. Knoxville. Our manufactured home loan at Sound Community Bank is perfect to make your dream a reality. No hidden or junk fees; Automatic payment transfers available. FHA loans are available for financing or refinancing manufactured homes with terms of up to 30 years and loans that offer low down payments and loosened credit. For manufactured homes on leased land or other properties, non-conforming manufactured home loans are available through our partner Triad Financial Services. Showing of 7 manufactured home lenders · 1st Security Bank · innosvet74.ru · Triad Financial Services · 21st Mortgage Corporation · Credit Human. What is a Manufactured Home Loan? · Purchase only · year term · Minimum credit score of · Property must have the title available or have been converted to. innosvet74.ru offers a range of personal property (chattel) financing options for Manufactured and Mobile homes. If you already own the land, you can use the land as your equity-down payment to purchase your home. SECU finances manufactured home purchases.

An investment property mortgage secured by a manufactured home is not eligible for sale to Freddie Mac. Execution Options. Servicing-released Cash; Servicing-. Finding a manufactured home loan does not have to be difficult; being able to compare qualified mobile home, modular home, or manufactured home lenders has. By partnering with us, families get the flexibility, speed and cost savings of a manufactured home loan, but with the unmatched personal service and local. IMHA's members include manufactured home lenders in Indiana. If you need financing for your manufactured home, they can help! These loans are specifically designed to help people purchase or refinance their manufactured homes. While manufactured home loans have higher interest rates. So unfortunately you are left needing to use alternative financing. There are very few alternative or Non QM (non qualified mortgage) lenders who will finance. 1st Choice Mortgage offers manufactured home loans for people with good and bad credit. Get a quote today, Find LOW rates in Idaho and the MOST loan. Type II manufactured home loans require a 15% down payment unless guaranteed by VA. Type II manufactured homes may only be financed under My Home. The value of. A manufactured home loan is treated more like a personal loan than a mortgage loan. Since the manufactured home is located on land you do not own, there is no. Most of the loan programs that are available for traditional stick built housing are also available for factory built homes. Florida Modular Homes and the. Buyers of manufactured homes may apply for a loan through a HUD-approved lender or through a lender's approved manufactured home dealer. Funding Status. Overview · Finance the purchase of a new or used manufactured home · Site the home on leased land in a community, land you own, or land you would like to purchase. We have fixed rates; We do not charge any pre-payment penalties; We do not require land; We finance homes located within a Park or Community; We finance new and. Often times when it comes to buying or building your own home, you're unsure of the renovations, upgrades or floorplan, which is why it's a good idea to opt for. There are many mortgage options for manufactured homes (formerly “mobile”), but there are special criteria to meet first. Manufactured homes can ease the nation's affordable housing shortage and Fannie Mae MH Advantage loans are a vehicle lenders can provide to homeowners. Manufactured homes consist of factory-built homes that have been engineered and constructed in accordance with the federal building code. It can be used for both a manufactured and modular homes. The minimum credit score for the is loan is with the 20% down payment being either land equity or. Construction requirements for FHA manufactured home loans · The home site has access to water and sewer facilities · The site has all-weather access · The. If you're financing just the home itself, you'll probably use a chattel loan. Check out the listings below to find a lender in Tennessee that can help you find.

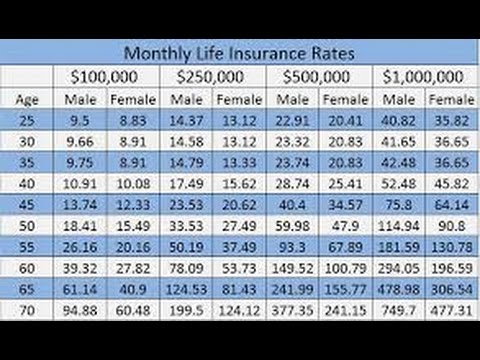

Life Insurance Cost Estimate

Answer a few questions about you and your life, and we'll give you an estimate of how much coverage you might need and about how much it could cost. The average cost of life insurance per month is $ How much you'll pay monthly for life insurance can depend on what you're looking for in a plan, so we don'. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. How much life insurance do I need? This life insurance calculator can help determine how much coverage is right for you. Our LifeTrek tool can help identify the level of life insurance protection you need, taking into account your finances and unique goals. Use the USAA life insurance calculator to estimate how much coverage you should have. Answer a few questions, and we will provide your life insurance needs. The average monthly term life insurance premium for a policy with a duration of ten years is $ per month for $, of coverage, $ for $, and. Our most recent Insurance Barometer Study revealed that people think life insurance costs three times more than it really does. Many people were surprised to. The cost of life insurance varies widely and is based on your age, your health and details about the policy you select. Answer a few questions about you and your life, and we'll give you an estimate of how much coverage you might need and about how much it could cost. The average cost of life insurance per month is $ How much you'll pay monthly for life insurance can depend on what you're looking for in a plan, so we don'. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. How much life insurance do I need? This life insurance calculator can help determine how much coverage is right for you. Our LifeTrek tool can help identify the level of life insurance protection you need, taking into account your finances and unique goals. Use the USAA life insurance calculator to estimate how much coverage you should have. Answer a few questions, and we will provide your life insurance needs. The average monthly term life insurance premium for a policy with a duration of ten years is $ per month for $, of coverage, $ for $, and. Our most recent Insurance Barometer Study revealed that people think life insurance costs three times more than it really does. Many people were surprised to. The cost of life insurance varies widely and is based on your age, your health and details about the policy you select.

The term life insurance calculator allows you to calculate the amount and the type of protection for your life insurance. Get an immediate estimate. Premiums are applicable during the Year Level Term period only. Premiums are based on monthly PAC premium payments. Qualification for the premium shown is. Life insurance helps you financially protect the ones you love. Use our calculator to determine how much coverage you need and get a quote from American. Just answer 10 or so questions about your debt, savings, expenses, etc. and we'll show a personalized estimate for a payout amount for your consideration. Try. Bankrate's life insurance calculator helps you hone in on the factors that affect the level of life insurance coverage you may want to buy. Use our easy Life Insurance Calculator to get a personalized estimate. Let's see how much life insurance you may need. Calculate your life insurance needs. The simplest and most basic method most insurance and financial professionals recommend is to buy at least 10 times your annual income in life insurance. For. The cost of life insurance may be less expensive than most people think. One survey found that respondents consistently overestimated the cost of term life. Quick Introduction to Whole Life Insurance ; Age. (yrs). Male. ($ per month) ; 25 - 35, $ - $ ; 35 - 45, $ - $ ; 45 - 55, $ - $ ; 55 - 65, $ -. Use this tool to estimate your monthly premium for life insurance coverage. It may be more cost-effective than you think. Our handy life insurance calculator will help you determine what your family's ongoing and one-time expenses are. Learn about factors that impact the cost of your life insurance policy and how much on average you can expect to pay depending on your age. A man of the same age and health status can expect life insurance costs of about $ a year. Whole life insurance, a type of permanent life insurance, offers. To get a life insurance cost estimate with MoneyGeek's life insurance cost calculator, input your personal data, including age, gender, health score and desired. Our life insurance calculator lets you compare different scenarios to calculate the death benefit amount that suits your life and priorities. Life insurance premium estimator. Enter the full-time annual salary for your position, even if you do not work full-time. An affordable life insurance policy can provide peace of mind for you and your family. GEICO makes it easy to get a life insurance quote. We'll run through how life insurance rates are calculated and offer a roundup of the life insurance products Corebridge Direct has to offer along with their. Individual life insurance accounts for 64 percent of all life insurance in force, with average policy sizes increasing from $, in to $, in

Are Taxis Or Uber Cheaper

SF taxis cost more than Uber due to regulations, but they could be budget-friendly considering stress and convenience. and iPad. Uber - Request a ride 4+. Rideshare, taxi cabs and more. Uber Technologies, Inc. #1 in Travel. • M Ratings. Free. iPhone Screenshots. We were in Montreal last week and found Taxi prices to be much less than Uber. We were quoted a high rate for Uber from the airport, and Taxi's have a flat. Request rides 24/7 and enjoy clear prices even when matching with a taxi in San Francisco Are taxis rides with Uber cheaper than UberX? Whether you're matched. Uber ; Ronald Sugar (chairman); Dara Khosrowshahi (CEO) · Taxi · Food delivery · Package delivery · Freight transport · Increase US$ billion () · Increase. TheBus Waikiki Service & Cost Details. A single ride on TheBus costs only $3 per person, making it a much cheaper option than taxis. Uber and Lyft are almost always cheaper than taxis. Taxis charge you per mile when the car is moving but charge per minute while you're idling. Uber's pricing model in Glasgow starts with a base fare, which is a fixed charge for every ride before distance and time rates apply. Taxis will always be more expensive than Uber or Lyft. In many instances, Uber and Lyft are more expensive than taxis. SF taxis cost more than Uber due to regulations, but they could be budget-friendly considering stress and convenience. and iPad. Uber - Request a ride 4+. Rideshare, taxi cabs and more. Uber Technologies, Inc. #1 in Travel. • M Ratings. Free. iPhone Screenshots. We were in Montreal last week and found Taxi prices to be much less than Uber. We were quoted a high rate for Uber from the airport, and Taxi's have a flat. Request rides 24/7 and enjoy clear prices even when matching with a taxi in San Francisco Are taxis rides with Uber cheaper than UberX? Whether you're matched. Uber ; Ronald Sugar (chairman); Dara Khosrowshahi (CEO) · Taxi · Food delivery · Package delivery · Freight transport · Increase US$ billion () · Increase. TheBus Waikiki Service & Cost Details. A single ride on TheBus costs only $3 per person, making it a much cheaper option than taxis. Uber and Lyft are almost always cheaper than taxis. Taxis charge you per mile when the car is moving but charge per minute while you're idling. Uber's pricing model in Glasgow starts with a base fare, which is a fixed charge for every ride before distance and time rates apply. Taxis will always be more expensive than Uber or Lyft. In many instances, Uber and Lyft are more expensive than taxis.

We wanted to see how the fare compares between a city taxi and an UberX driver here in Grand Rapids. Here are the results. The bottom line: Uber can be less expensive than a taxi or car service, but not consistently. One point in its favor, though, is that Uber tells you exactly. It costs ~$, including tip, to take a cab from the San Juan airport to Aguadilla (-$20) or Aguada, Puerto Rico. It costs ~$ to rent a car from the San. Welcome to Yorba Linda taxis with Uber, where local cab drivers may fulfill UberX requests. Are taxis rides with Uber cheaper than UberX? Whether you're. Since you already have a car, there is no way that Uber can be cheaper because taking Uber requires paying for gas and the human driver, while. How much do Uber, Lyft, and Taxis cost? Ola, Didi and Limos? Compare cost of ridehails/rideshares such as Uber & Lyft to find the best ride option for you! For shorter distances within the city, public transportation like buses and trams are usually less expensive compared to Uber. However, Uber may be more cost. Want to know the cheapest way from the airport to the city? Check out our simple tool and discover the cheapest way to travel in the world's major cities. We wanted to see how the fare compares between a city taxi and an UberX driver here in Grand Rapids. Here are the results. Request rides 24/7 and enjoy clear prices even when matching with a taxi in San Francisco Are taxis rides with Uber cheaper than UberX? Whether you're matched. In Seattle, traditional cabs are 50% cheaper than Ubers to go from Seatac to the city. On the other hand, taxis have set prices and may be cheaper during off-peak hours or for shorter distances. Businesses can always go for On-. Infographic: Where is a taxi cheaper than Uber? Trending. August 21, There is no “one size fits all” answer. Are you traveling on business and looking. Compare passenger fares and driver pay for Uber, Lyft, and taxi trips in New York City. Though some question the safety of ridesharing services, Uber and Lyft are generally as safe to use as taxis are. However, it's important to know more about. Find a nearby taxi now with Uber in select UK cities. Next time you search “taxi near me,” open the Uber app instead and see if Uber Taxi is available near. Uber to make it easier and cheaper to procure direct transportation. Camp "Uber tackles Taxis in Chicago with Uber Garage experiment". Engadget. Welcome to Long Beach taxis with Uber, where local cab drivers may fulfill UberX requests. Are taxis rides with Uber cheaper than UberX? Whether you're. A Current Affair put the two to the test, comparing which is the cheapest, fastest and most reliable way to get from A to B. Taking Uber or Lyft to and from work and to run errands might seem more expensive than driving yourself–but in many cases, relying on a ride-hailing service.

Income Limits For Third Stimulus Check

Americans with income below a certain threshold — $75, for individuals, $, for heads of household and $, for couples filing jointly — will each. Met the California adjusted gross income (CA AGI) limits described in the What you may have received section Received your Golden State Stimulus (GSS) For example, a single person with no dependents and an AGI of $77, will have a maximum credit of $ (half the full amount). Married taxpayers who file a. eligibility limits, you should realize that filing your return before Congress passes the legislation will mean you likely won't a third stimulus payment. Table 3: Partial Credit Income Limits by County ; Caledonia, $31,, $36, ; Chittenden, $39,, $45, ; Essex, $31,, $36, ; Franklin, $32, Adults whose adjusted gross income is less than $75,/year (or couples who file together whose adjusted gross income is less than $,) will get $1, U.S. citizens and permanent residents can use this tool if they had gross income that did not exceed $12, ($24, for married couples filing jointly) for. To qualify for the payment, an individual filing or income tax as a single person had to make less than $75, in adjusted gross income. The limit. Normally, a taxpayer will qualify for the full amount of Economic Impact Payment if they have AGI of up to $75, for singles and married persons filing a. Americans with income below a certain threshold — $75, for individuals, $, for heads of household and $, for couples filing jointly — will each. Met the California adjusted gross income (CA AGI) limits described in the What you may have received section Received your Golden State Stimulus (GSS) For example, a single person with no dependents and an AGI of $77, will have a maximum credit of $ (half the full amount). Married taxpayers who file a. eligibility limits, you should realize that filing your return before Congress passes the legislation will mean you likely won't a third stimulus payment. Table 3: Partial Credit Income Limits by County ; Caledonia, $31,, $36, ; Chittenden, $39,, $45, ; Essex, $31,, $36, ; Franklin, $32, Adults whose adjusted gross income is less than $75,/year (or couples who file together whose adjusted gross income is less than $,) will get $1, U.S. citizens and permanent residents can use this tool if they had gross income that did not exceed $12, ($24, for married couples filing jointly) for. To qualify for the payment, an individual filing or income tax as a single person had to make less than $75, in adjusted gross income. The limit. Normally, a taxpayer will qualify for the full amount of Economic Impact Payment if they have AGI of up to $75, for singles and married persons filing a.

Yes, expats qualify for the third stimulus check. You qualify if you fall within the income threshold, have a social security number, and file taxes — even if. The Internal Revenue Service (IRS) based the amounts that individuals received on income, tax filing status, and number of children (or qualifying dependents. The stimulus payment is a tax rebate, and does not count as cash assistance. Will the stimulus rebate count as income when determining eligibility for. check multiple times per day. While the third round of stimulus checks tightened some of the upper income limits for who is eligible, a larger group of. To see how large your third stimulus payment should have been, answer the three questions in the calculator below and we'll give you a customized estimate. Above these income limits, the payment amount decreases five percent for every additional $ of income up to $99, for a single adult, $, for head. The Arizona Department of Revenue has launched a site that contains resources on how to check your eligibility and rebate status, and file a claim or update. $, to $, as a head of household filer; $, to $, as a joint filer. Stimulus Round 3 (distributed in ). Qualifications. The ARP provided stimulus checks of $1, for each single adult and dependent child, and $2, for each married couple that met the income threshold. There are also income limits. Each of the three checks is available in full to single tax filers with an income under $75, Heads of house with an income. Incarcerated people are eligible for the stimulus payment if they meet the eligibility guidelines. You should have received an automatic payment if you: Filed. Eligibility is primarily based on four requirements: 1. Income: The income requirements to receive the full payment are the same as the first stimulus check. 3. COVID relief packages passed by Congress provided three rounds of stimulus payments. If you are unsure about the eligibility and contents of each EIP, you. Adults who earned less than $75, should have received a full payment, with reduced payments to those earning up to $80,; married couples who earned up to. Adults who earned less than $75, should have received a full payment, with reduced payments to those earning up to $80,; married couples who earned up to. The third stimulus payment requires the eligible recipient to be a US citizen or resident alien, possess a Social Security number, and not be claimed as a. I need help getting a rescue payment. A typical family of 4 with a household income of $, is eligible for an average of $5, in rescue funds. Claim your. three times higher than the share for households in the highest income quartile. income Canadians (Chart ). This includes the Surplus Food Rescue Program. The calculator below will display the amount you can expect to get, depending on your income and whether you have dependents. The government sets eligibility requirements for stimulus checks, which means not everyone is entitled to receive them. Stimulus checks were used during the.

Automobile Interest Rates

One of the main factors lenders consider when you apply for a loan is your credit score. A higher score can help you secure a better interest rate—which means. As of 9/6/23, annual interest rates range from % APR to % APR. The lowest APRs require an auto-debit discount and are available only to borrowers with. Auto loan rates as low as % APR for new vehicles. Apply Nowfor an auto loan. Today's New & Used Car Loan Rates. Loan example: $30, loan with a month term and % APR is $, excluding the $40 loan processing fee or any additional loan vehicle coverage options. Drive away with competitive rates and flexible terms on a new or used car, truck or SUV. U.S. Bank offers rates as low as % on loans of at least $40, New Purchase Auto Loans · Interest rates as low as % APR* · Financing terms up to 84 Months · Pre-qualification with no credit impact. Mountain America auto loan features: · Fixed auto loan interest rates as low as % APR¹ with MyStyle® Checking discount · No application fees · Terms up to six. Auto Loan Rates ; New Auto. % ; New Auto. % ; New Auto. % ; New Auto. 84 · %. Auto Loan Rates ; Credit score range. Average interest rate ; to % ; to % ; to % ; to %. One of the main factors lenders consider when you apply for a loan is your credit score. A higher score can help you secure a better interest rate—which means. As of 9/6/23, annual interest rates range from % APR to % APR. The lowest APRs require an auto-debit discount and are available only to borrowers with. Auto loan rates as low as % APR for new vehicles. Apply Nowfor an auto loan. Today's New & Used Car Loan Rates. Loan example: $30, loan with a month term and % APR is $, excluding the $40 loan processing fee or any additional loan vehicle coverage options. Drive away with competitive rates and flexible terms on a new or used car, truck or SUV. U.S. Bank offers rates as low as % on loans of at least $40, New Purchase Auto Loans · Interest rates as low as % APR* · Financing terms up to 84 Months · Pre-qualification with no credit impact. Mountain America auto loan features: · Fixed auto loan interest rates as low as % APR¹ with MyStyle® Checking discount · No application fees · Terms up to six. Auto Loan Rates ; New Auto. % ; New Auto. % ; New Auto. % ; New Auto. 84 · %. Auto Loan Rates ; Credit score range. Average interest rate ; to % ; to % ; to % ; to %.

New Auto Loan Rates ; 36 - 63 Months, % - % ; 64 - 72 Months, % - % ; 73 - 84 Months, % - % ; 85 - 96 Months, % - %. Auto Loan Rates ; & Newer Vehicle Rates · 1 · % · $ per $1, · % ; Vehicle Rates · 2 · % · $ per $1, · % ; & Older. Used Car Loans ; 48 Months, % APR ; 63 Months, % APR ; 75 Months, % APR ; 10 Years or older, % APR. You've found the perfect car and we can help you finance it at a perfect rate. We offer interest rates as low as % so you can save money while getting. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. If automatic payment ceases before the loan is paid in full, the interest rate will increase by %. Auto loan application must be submitted between 8/15/ Automobile Loans ; New and Current Used · · * * * · % % % % ; Two-Year-Old Vehicles · · * * * · % %. **Example: A $15, used vehicle loan with no down payment will be paid in 48 months with a payment of $ at the disclosed APR. APR = Annual Percentage. Used Car Loans ; 48 Months, % APR ; 63 Months, % APR ; 75 Months, % APR ; 10 Years or older, % APR. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. Auto Loans ; New & Used Recreational Vehicle Loan, months, %, $ ; New & Used Recreational Vehicle Loan · months ($20K min), %, $ Average Auto Loan Rates in July ; Average Auto Loan Rates for Excellent Credit · or higher, %, %, % ; Average Auto Loan Rates for Good Credit. Get on the road with low interest rates ; Model Year, 66 Months, % APR ; Model Year, 72 Months, % APR ; Model Year, 48 Months, Loan example: $30, loan with a month term and % APR is $, excluding the $40 loan processing fee or any additional loan vehicle coverage options. Compare car loans from multiple lenders to find the best rate · Navy Federal Credit Union: Best car loan for those with military connections · Southeast Financial. Get on the road with low interest rates ; Model Year, 66 Months, % APR ; Model Year, 72 Months, % APR ; Model Year, 48 Months, New Purchase Auto Loans · Interest rates as low as % APR* · Financing terms up to 84 Months · Pre-qualification with no credit impact. On a $35, auto at % APR for 84 months, your monthly payment would $/ month. Financing up to 84 months available for qualifying vehicles. Maximum loan-. As of 9/6/23, annual interest rates range from % APR to % APR. The lowest APRs require an auto-debit discount and are available only to borrowers with.

Credit Cards Low Apr No Balance Transfer Fee

Another card to consider: The Citi® Diamond Preferred® Card offers an intro APR of 0% for 12 months on purchases and 0% for 21 months on Balance Transfers. You can get a % intro APR for 12 months from account opening on balances transferred within 60 days. You'll also pay no balance transfer fees. Low Rate Credit Card Benefits · New Cardholders: 0% for 12 months introductory APR · No annual fee. · No balance transfer fees. Save money when you switch to one of our low-interest credit cards. Transfer All three options include a low rate and no or low transfer fees. Moving high-interest debt to a credit card with 0% APR can be a big money-saver! Generally, you'll have to pay a balance transfer fee — usually, 3% to 5% of the. Balance transfer 0% introductory APR for first 15 billing cycles after account opening. After that, %, % or % variable APR based on your. We analyzed popular balance transfer cards with no balance transfer fee using an average American's annual spending budget and credit card debt. 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. The Choice Rewards World Mastercard® from First Tech Federal Credit Union is a well-rounded card that has no annual fee, no foreign transaction fees, and a. Another card to consider: The Citi® Diamond Preferred® Card offers an intro APR of 0% for 12 months on purchases and 0% for 21 months on Balance Transfers. You can get a % intro APR for 12 months from account opening on balances transferred within 60 days. You'll also pay no balance transfer fees. Low Rate Credit Card Benefits · New Cardholders: 0% for 12 months introductory APR · No annual fee. · No balance transfer fees. Save money when you switch to one of our low-interest credit cards. Transfer All three options include a low rate and no or low transfer fees. Moving high-interest debt to a credit card with 0% APR can be a big money-saver! Generally, you'll have to pay a balance transfer fee — usually, 3% to 5% of the. Balance transfer 0% introductory APR for first 15 billing cycles after account opening. After that, %, % or % variable APR based on your. We analyzed popular balance transfer cards with no balance transfer fee using an average American's annual spending budget and credit card debt. 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. The Choice Rewards World Mastercard® from First Tech Federal Credit Union is a well-rounded card that has no annual fee, no foreign transaction fees, and a.

0% for 21 months on Balance Transfers and 12 months on Purchases · % - % (Variable) · N/A* · $0. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms. With an APR as low as % and no annual or balance transfer fees, our low rate credit card is great for large purchases you want to pay off over time. Rate Preferred Mastercard® · APR as low as % on purchases and cash advances* · Balance transfers as low as % APR* · No annual fee · No balance transfer fee. BankAmericard® credit card. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. Swing Into Savings With a CRCU Mastercard®! · Consolidate & simplify your finances · Pay down balances at a lower interest rate · NO balance transfer fee · NO. By transferring your balance to a card with a 0% intro APR, you can quickly dodge mounting interest costs and give yourself repayment flexibility. However. No fee and 0%? None that I've ever seen and I have almost every credit card. Almost all cards will be 0% balance transfers but the fee can range. Balance transfers give you the chance to move high-interest credit card balances from one card over to a different card with a low or zero percent introductory. Welcome offer: You could get a 0% promotional annual interest rate (“AIR”) for 12 months on balance transfers completed within 90 days of account opening. 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms for details. transfer in a balance from another card, typically at a low introductory APR. no interest and just a fee to transfer the balance. But details and costs. Citi Custom Cash® Card · 5% |or 1%Cash Back · Low intro APRon purchases & balance transfers · No annual fee. Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer. Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. Why this is one of the best 0% introductory APR credit cards: The Wells Fargo Reflect card comes with a 0% intro APR for 21 months from account opening. After. %, % or % variable APR thereafter. Balance transfers made within days from account opening qualify for the introductory rate. Annual fee. $0. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Enjoy a low intro APR on purchases and balance transfers for 18 months from account opening. Balance transfer fee applies, see pricing and terms for more.